stock market bubble meaning

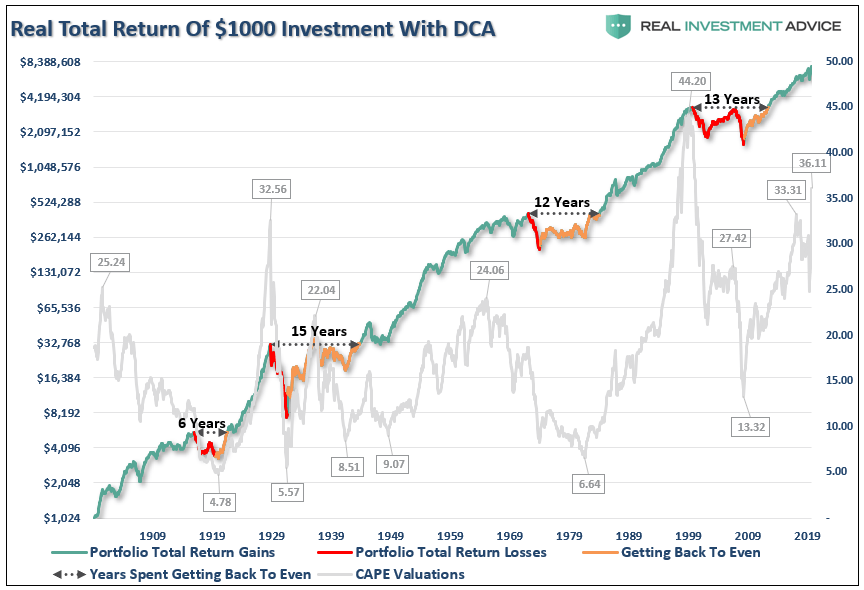

In my trades I aim to get back three times as much money as I. Typically prices rise quickly and significantly growing.

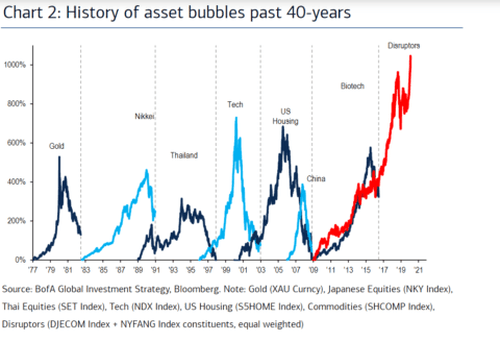

Stock Market Crash Ahead The 2021 Stimulus Bubble 7 Key Bubble Factors Youtube

A compelling story is one of the best frameworks for creating a stock bubble.

. Typically prices rise quickly and significantly growing far beyond their previous value in a short period of time. Because there is disagreement between market participants as to that value bubbles can be hard to detect as they are taking place. What is a Stock Market Bubble.

A story has captured the markets imagination. The most common parameter to judge the. The term is commonly used when talking.

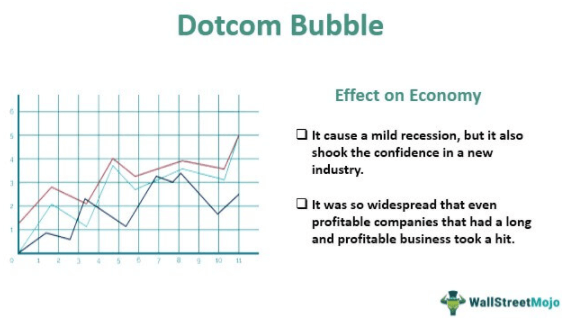

The dotcom bubble of. Stock market bubbles involve equitiesshares of stocks that rise rapidly in price often out of proportion to their companies fundamental value their earnings assets etc. A stock bubble is a hypothetical lament that stock prices are just too high.

While in many respects the stock market looks like a bubble the underlying foundation is different. Behavioral finance theory attributes stock market bubbles to cognitive biases that lead to groupthink and herd behavior. Grantham added that as bubbles form they give us a ludicrously overstated view of our real wealth.

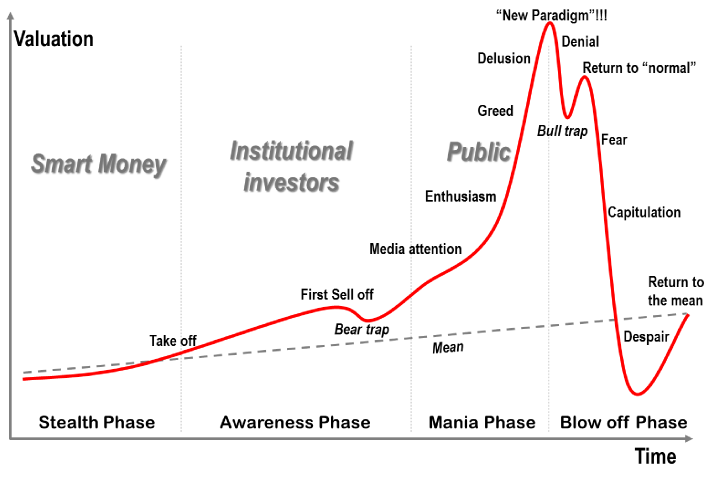

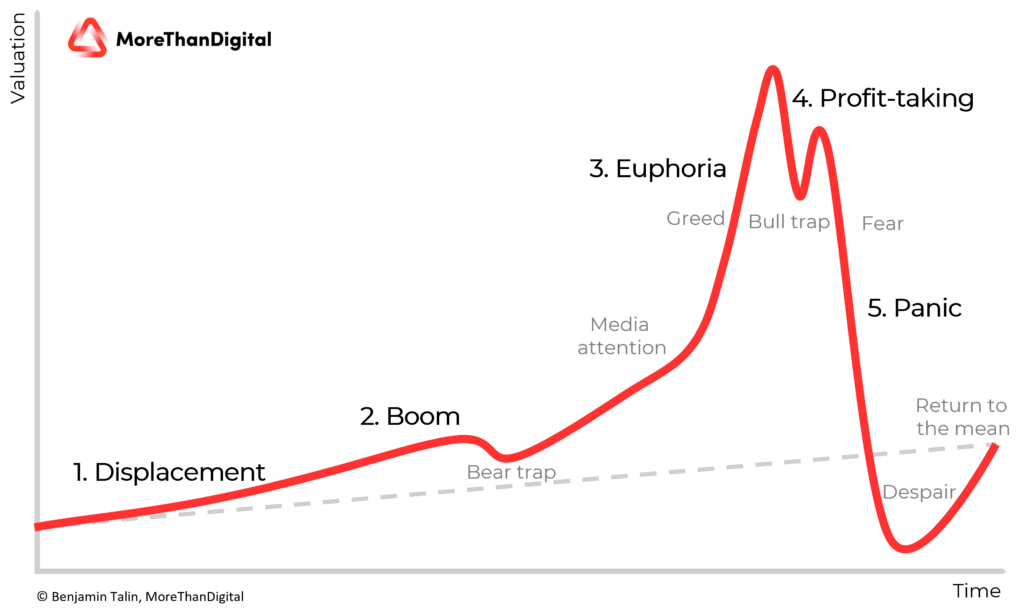

A stock market bubble refers to a surge in share prices to levels significantly above their fundamental value. They could also be described as prices which strongly exceed the assets intrinsic value. The five steps in a bubble are displacement boom euphoria profit-taking and panic.

Followed by a gradual or sudden decline burst in their prices as investors offload their holding in them. This fast inflation is followed by a quick decrease in value or a contra. Stock Market Bubble Definition is very simple ie.

When they fall they do so quickly and often below the starting value. Stock market bubble definition Sunday May 15 2022 Edit. If you put your money in the market you want to get back more than you put in.

Its not always clear what too high means because few people who complain about bubbles bother to explain the basis of a fair valuation but there are some measurements you can. That doesnt mean it cant go down of course potentially by a lot. A stock market bubble is a type of economic bubble taking place in stock markets when market participants drive stock prices above their value in relation to some system of stock valuation.

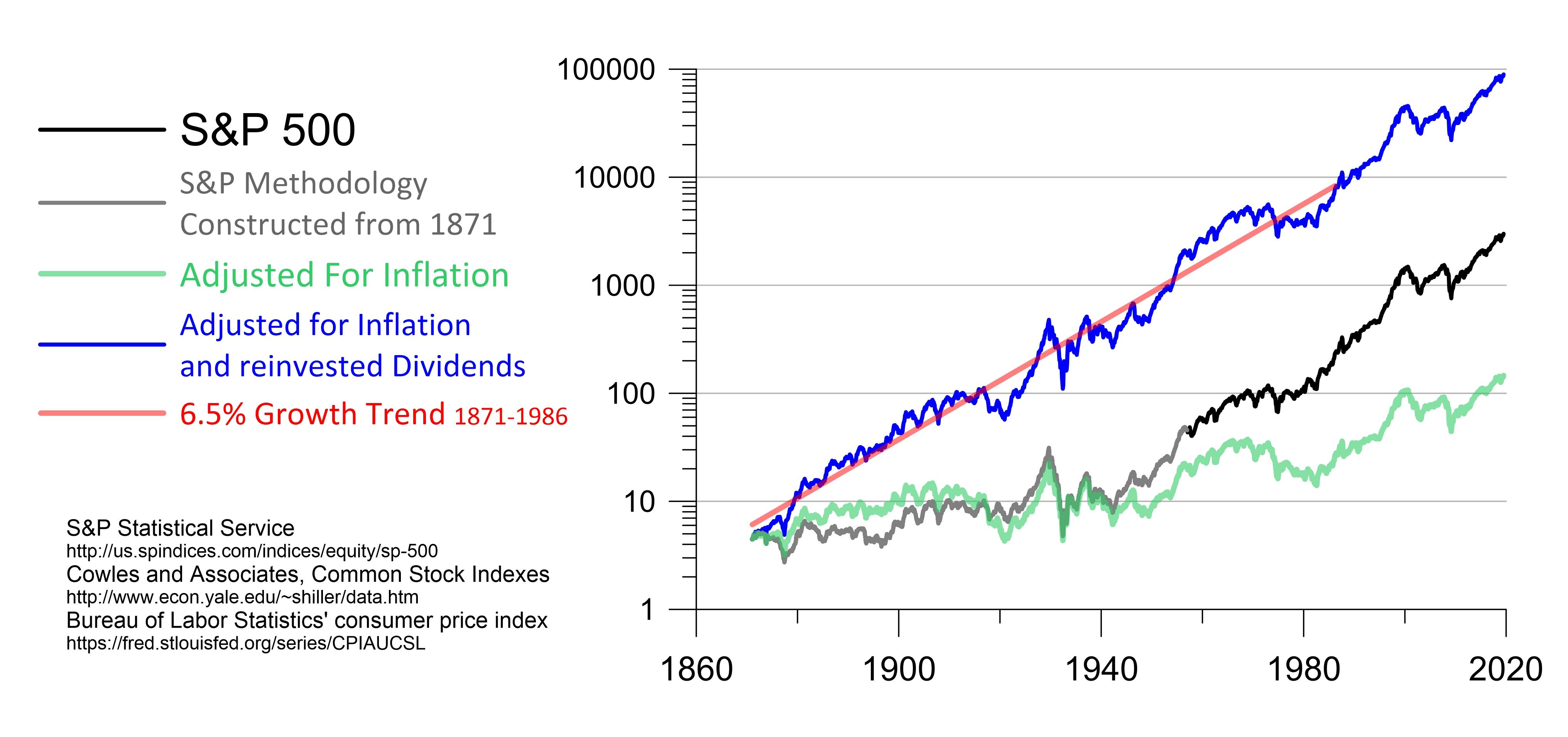

Rising corporate profits a product of cost-cutting and productivity increases drove up stock prices. A stock market bubblealso known as an asset bubble or a speculative bubbleis when prices for a stock or an asset rise exponentially over a. A stock market bubble is a period of growth in stock prices followed by a fall.

This is a very expensive market but its likely not a bubble. A bubble is a sudden rise in the prices of stocks belonging to a particular sector buoyed by investor belief in the future performance potential that makes them attain values which are far beyond their intrinsic price. Jeremy Grantham co-founder of hedge fund GMO is warning that stocks could fall a lot further.

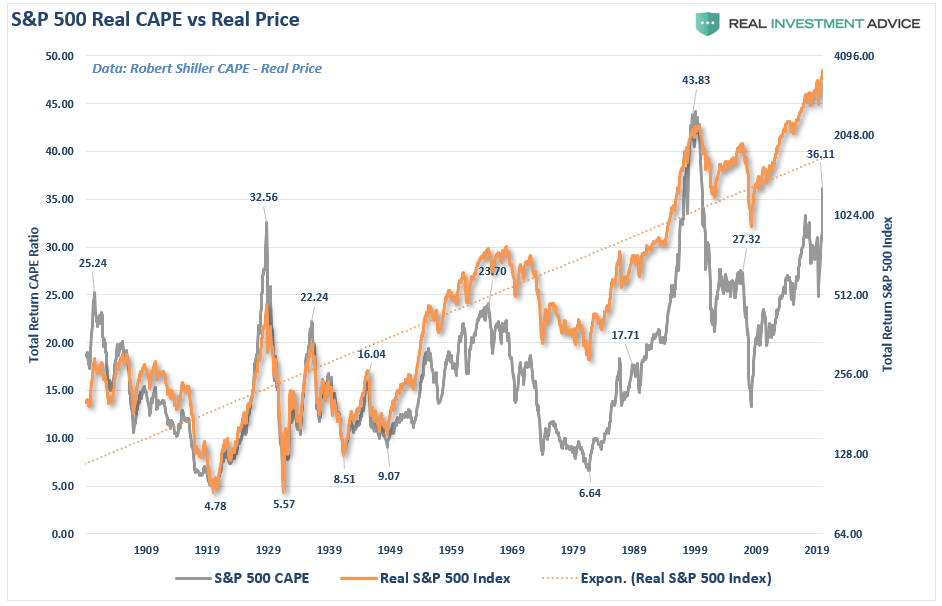

The SP had its best year since 1997 posting gains of 3239. The stock market took off in 2013. Bubbles are sometimes caused by unlikely and overly optimistic projections about the future.

Bubbles occur not only in real-world markets with their inherent. 2013 Stock Market Bubble. Since a large part of what appears to be driving prices isnt sentiment the answer is likely no.

A bubble is defined as a period when prices rise rapidly outpacing the true worth or intrinsic value of an asset market sector or an entire industry such as. When the stock price does not justify the valuation of the stocks. An economic bubble is a situation in which asset prices are much higher than the underlying fundamentals can reasonably justify.

An economic bubble also known as a market bubble or price bubble occurs when securities are traded at prices considerably higher than their intrinsic value followed by a burst or crash when prices tumble. Stock market bubble is a term thats used when the market appears exceptionally overvalued driven by a combination of heightened enthusiasm unrealistic expectations and reckless speculation. They are sometimes referred to as speculative bubbles.

A stock market bubble is a period of growth in stock prices followed by a fall. The Dow Jones Industrial Average experienced a gain of 2650its largest in 18 years. A bubble is an economic cycle that is characterized by the rapid escalation of market value particularly in the price of assets.

A stock market bubble is a type of economic bubble taking place in stock markets when market participants drive stock prices above their value in relation to some system of stock valuation. Its a complaint that stock prices are unrealistic based on the value of those stocks. A stock market bubble is a type of economic bubble taking place in stock markets when market participants drive stock prices above their value in relation to some system of stock valuation.

A stock market bubble happens when a stock costs a lot more than its worth or the market in general is overvalued. A stock market bubble is a significant run-up in stock prices without a corresponding increase in the value of the businesses they represent.

What Is A Stock Market Bubble Forbes Advisor

Yes Virginia There Is A Stock Market Bubble Seeking Alpha

:max_bytes(150000):strip_icc()/dotdash_INV_final_Irrational_Exuberance_Jan_2021-01-45e4d7c38e1f47f290063b49bf234f9a.jpg)

Irrational Exuberance Definition

Stock Market Super Bubble And The Demographic Trigger Seeking Alpha

Dotcom Bubble Meaning Causes Effect On Economy

Investors Can T Ignore This Clear Sign Of A Stock Market Bubble Seeking Alpha

Stocks In Germany The Uk France Italy And Spain Plunge Below Year 2000 Levels Buy And Hold Horror Shows Wolf Street

Are We In A Stock Market Bubble Right Now Stopsaving Com

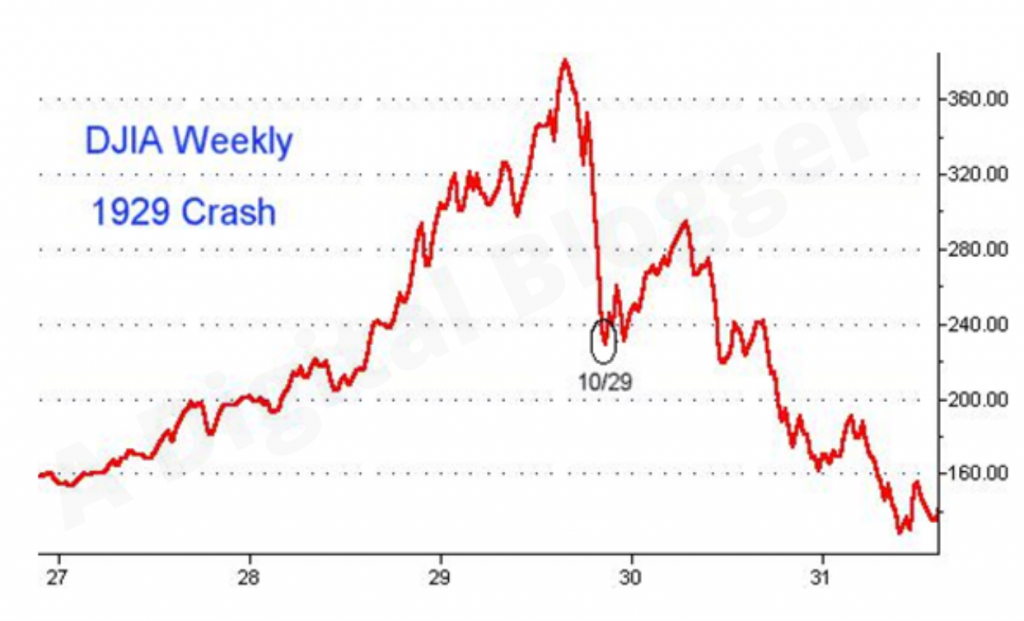

Warning Signs Investors Ignored Before The 1929 Stock Market Crash History

Yes Virginia There Is A Stock Market Bubble Seeking Alpha

Yes Virginia There Is A Stock Market Bubble Seeking Alpha

What Is A Stock Market Bubble The Motley Fool

Stock Market Crash 1929 Definition Facts Timeline Causes Effects

Economic Bubble Definition Types And 5 Stages Of Financial Bubbles Morethandigital

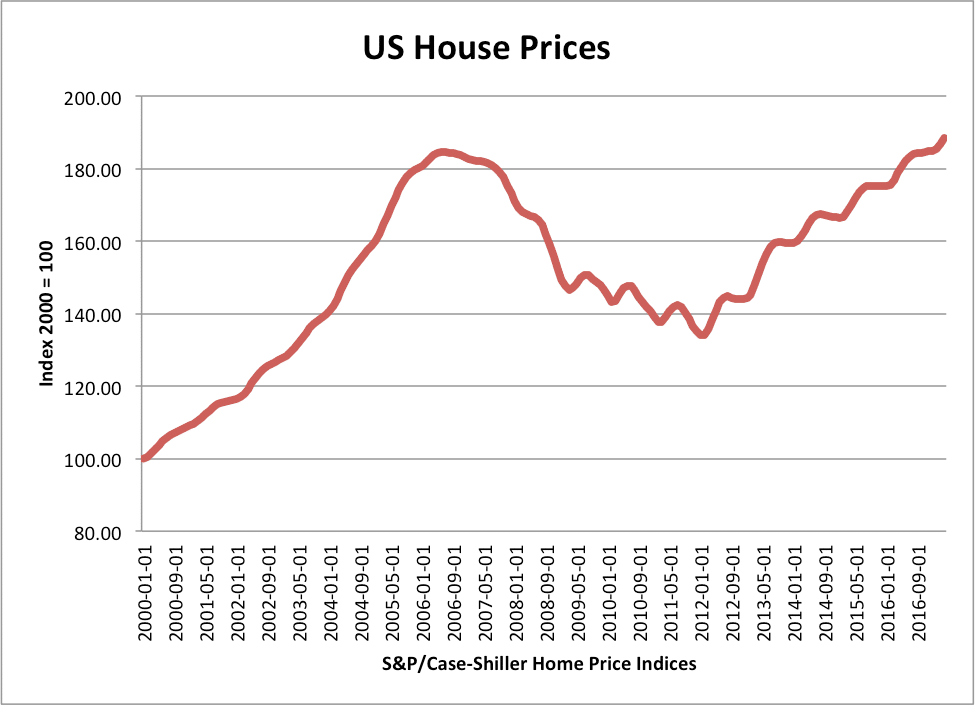

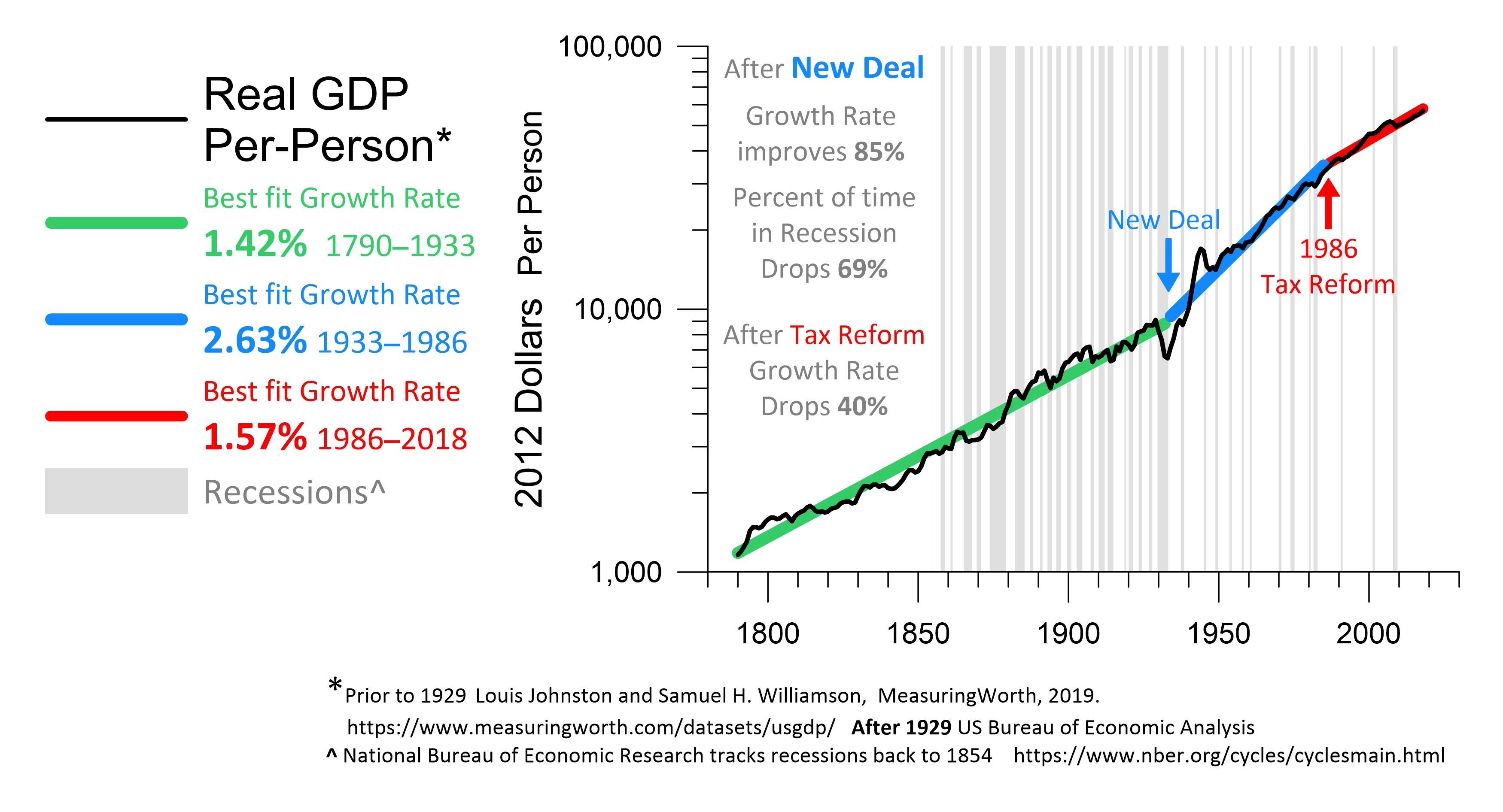

Types And Causes Of Financial Bubbles Economics Help

Types And Causes Of Financial Bubbles Economics Help

Stock Market Super Bubble And The Demographic Trigger Seeking Alpha

:max_bytes(150000):strip_icc()/dotdash_INV_final-Tech-Bubble_Feb_2021-01-f60580df62c24a79830dfb739e76af50.jpg)

:max_bytes(150000):strip_icc()/dotdash_INV-final-Stock-Market-Crash-July-2021-01-88a96c7bec2846dd9986a5777c089417.jpg)