wisconsin private party car sales tax

You take the title and a completed MV-1 Form to a DMV office along with your ID sales tax and registration fees and you will receive title plates and registration all in one stop. Be sure that the VIN is legible.

Google Image Result For Http Www Appraisercitywide Com Xsites Appraisers Appraisercitywide Content Uploadedfiles Zion 2520 320 2 Suburbs Chicago Suburbs Zion

Contact the DMV Dealer Agent Section at 608 266-1425 or dealerlicensingunitdotwigov Sell it right.

. 25000 for the injury or death of a single person. Staying within budget when youre car shopping doesnt have to be difficult if you know what. The state of Wisconsin does not usually collect sales taxes on the vast majority of services performed.

However some services like those which have to do with manufacturing or creating products are generally considered taxable. Tax on Rebates Dealer Incentives You do have to pay tax on dealer rebates and incentives. The national highway traffic safety administrations nhtsa odometer disclosure requirements were updated in december 2020 impacting certain private vehicle sales in wisconsin.

Publication 202 517 Printed on Recycled Paper. In order to obtain a refund of Wisconsin sales or use tax paid in error you must file a refund claim with the Department of Revenue. Address 123 Main Street New York NY 10001.

Proof of insurance that meets the minimum state requirements. Sales tax is collected based on where the vehicle is going to be registered in your case Wisconsin. The total tax rate also depends on your county and local taxes which can be as high as 675.

The most expensive standard sales tax rate on car purchases in general is found in California. The fact the seller is out-of-state is essentially irrelevant. Title Fees Title fees for a standard automobile in Wisconsin cost 16450 for the original title or title transfer.

50000 for the injury or death of more than one person. In Wisconsin the state sales tax rate of 5 applies to all car sales. Drivers license or other valid photo ID.

To calculate how much sales tax youll owe simply multiple the vehicles price by 006625. Effective October 1 2009 all retailers that are registered to collect and remit Wisconsin sales and use taxes must also collect and remit the applicable state county andor. Date of sale Price.

WisDOT collects sales tax due on a vehicle purchase on behalf of DOR. The Wisconsin Division of Motor Vehicles offers a downloadable form Instructions for Selling a Vehicle Form MV2928 that outlines the steps when making a private party purchase. 900AM500PM Saturday Sunday.

As an example if you purchase a truck from a private party for 20000 then you will pay 5 of that amount to the Wisconsin DMV. The average Wisconsin car sales tax including state and county rates is 5481. A sales tax is required on all private vehicle sales in Wisconsin.

Important Changes Menominee County tax begins April 1 2020 Baseball stadium district tax ends March 31 2020 Outagamie County tax begins January 1 2020 Calumet County tax begins April 1 2018. If not applying online a Title and License Plate Application Form MV1 A Bill of Sale is not required but is recommended. Wisconsin is one of the easiest states to accomplish this in.

If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale. This document can be viewed and. The sales tax charged on car purchases in Wisconsin is 5 so you can expect to pay at least 5 of the total vehicle price for the tax fee.

That tax rate is 725 plus local tax. In addition there may be county taxes of up to 05 along with a stadium tax of up to 01. Brief description of the transaction and reason for the refund Legible copy of the Form MV-1.

That amount is 1000. The average sales tax rate on vehicle purchases in the United States is around 487. Wisconsin private party car sales tax Sunday May 29 2022 Wisconsin collects a 5 state sales tax rate on the purchase of all vehicles.

You pay the owner who signs the title and gives it to you. How Much is the Average Sales Tax Rate on Cars. For a vehicle transfer that occurs from january 1 2021 through december 31 2030 any vehicle of model year 2011 or newer 2012 2013 etc will require an odometer.

If sales tax is paid in error tax refund requests must be made directly. This includes a bill of sale. As of January 1 2016 you must notify the Department of Transportation within 30 days if you have sold a vehicle.

The claim must be submitted in writing and should include the following. Wisconsin law says you can sell up to five vehicles titled in your name in 12 months. Some dealerships also have the option to charge a dealer service fee of 99 dollars.

There are also county taxes of up to 05 and a stadium tax of up to 01. Call DOR at 608 266-2776 with any sales tax exemption questions. However certain states have higher tax rates under certain conditions.

Sales and Use Tax. They collect it at the time of the sale in other words title transfer just as you would pay sales tax at insert store name at the time of the sale. If you sell more than five or if you buy even one vehicle for the purpose of reselling it you must have a de aler license.

Wisconsin collects a 5 state sales tax rate on the purchase of all vehicles. Vehicle identification number VIN of the vehicle The name of the buyer Im buying a vehicle from a private seller. Any taxes paid are submitted to DOR.

But if the original sales price plus the improvements add up to 8000 and you sell the car for 10000 youll have to pay capital gains tax on your 2000 profit. Motor Vehicle Sales Leases and Repairs. This includes junked vehicles sold with a bill of sale.

Trade In Car Or Sell It Privately The Math Might Surprise You

Nj Car Sales Tax Everything You Need To Know

Free Car Loan Application Form Bad Credit Car Loan Best Payday Loans Payday Loans

Free Wisconsin Motor Vehicle Bill Of Sale Pdf Eforms

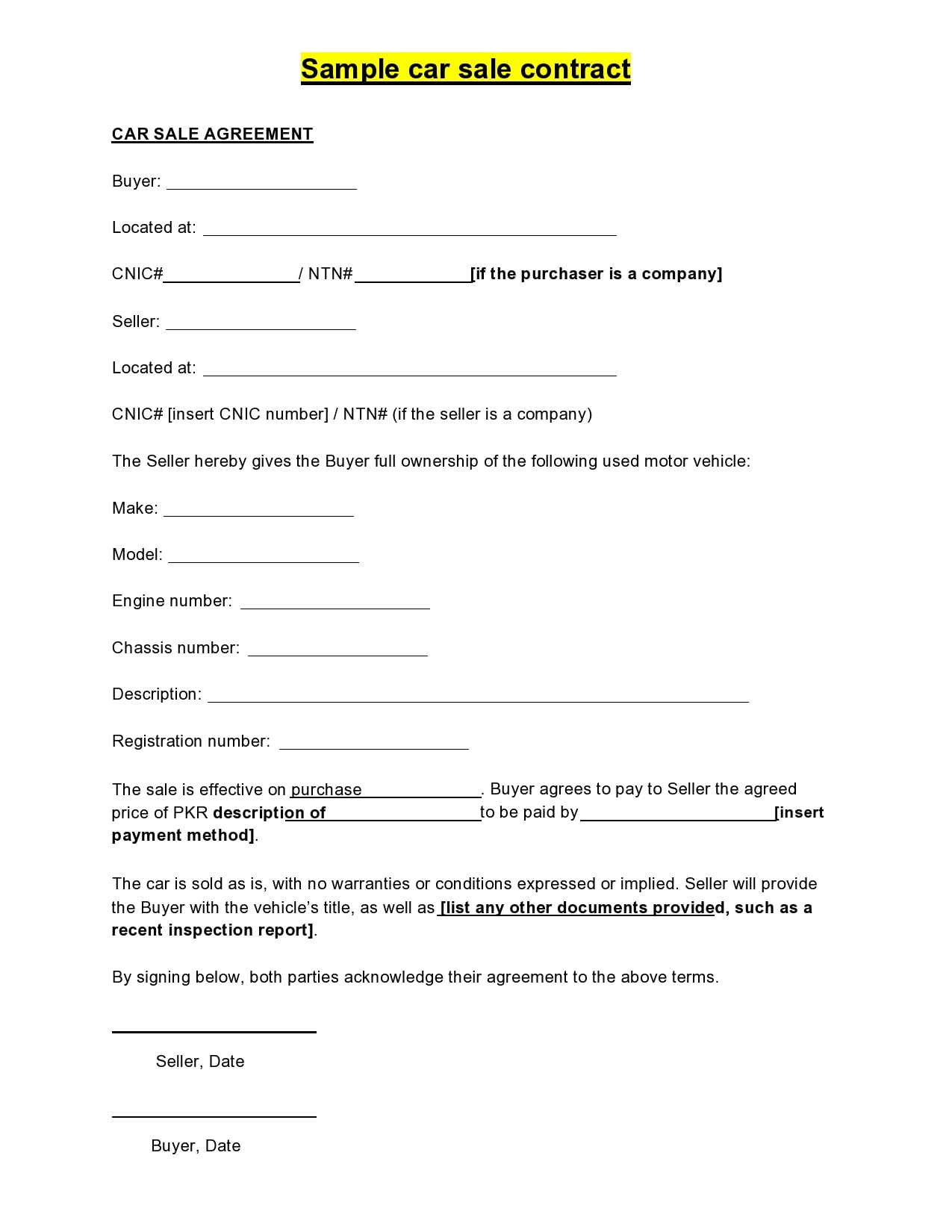

30 Simple Car Sale Contract Templates 100 Free

How To Buy A Car From A Private Seller Carfax

How To Buy A Car From A Private Seller Carfax

Car Tax By State Usa Manual Car Sales Tax Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

7 Ways To Protect Yourself When Selling A Car Kelley Blue Book

Free Vehicle Private Sale Receipt Template Pdf Word Eforms

A Complete Guide To Car Dealer Fees Carfax

Car Bill Of Sale Pdf Printable Template As Is Bill Of Sale

What Are The Pros And Cons Of Buying A Car From Carvana

What Is The Sales Tax On A Car In Illinois Pasquesi Sheppard Llc

Trade In Sales Tax Savings Calculator Find The Best Car Price

Wisconsin Department Of Transportation Rolls Out New Law On Selling A Car Private