how to calculate nh property tax

Municipal local education state education county and village district if any. New Hampshire DMV Registration Fees.

What You Should Know About Moving To Nh From Ma

The registration fee decreases for each year old the vehicle is.

. If married filing jointly and you earned between 80801 501600 your tax rate is 15 and over 501600 the tax rate is 20. New Hampshire income tax rate. Data and information contained within spreadsheets posted to the internet by the Department of Revenue Administration Department is intended for informational purposes only.

Use this free New Hampshire Mortgage Calculator to estimate your monthly payment including taxes homeowner insurance principal and interest. Tax amount varies by county. 10 12 22 24 32 35 and 37.

Lets break down the calculation. This calculator is based upon the State of New Hampshires Department. This manual was the result of a collaboration of dedicated professionals who volunteered their time and knowledge in the hope of shedding light on how the property tax works.

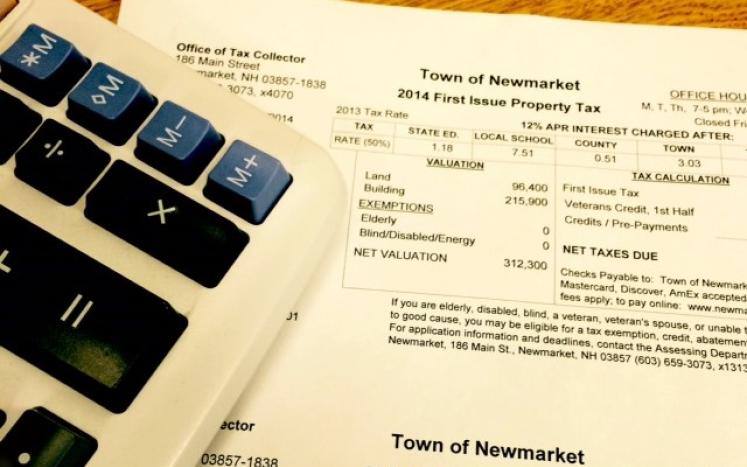

Multiply the rate by 1000 and you get the property tax rate per 1000 of property value which is how the rate is usually stated. Find All The Record Information You Need Here. To calculate the annual tax bill on real estate when the property owner isnt eligible for any exemptions multiply the assessed value by the total tax rate and divide the.

Then they calculate the tax rates required to equal those budgeted expenditures. The median property tax on a 24970000 house is 262185 in the United States. The formula to calculate New Hampshire Property Taxes is Assessed Value x Property Tax Rate1000 New Hampshire Property Tax.

In theory at least total proceeds will equal the fund required for all previewed undertakings that year. Under those two limits the tax rate is 0. The assessed value 300000 is divided by 1000 since the tax rate is based on every 1000 of assessed value.

This all depends on whether youre filing as single married jointly or married separately or head of household. See Property Records Tax Titles Owner Info More. The State of NH imposes a transfer fee on both the buyer and the seller of real estate at the rate of 750 per 1000 of the total price.

This states transfer tax is 075 of the sale paid by both buying and selling parties for a total aggregate of 15. We genuinely invite commentary from the public. The assessed value of the property.

The local tax rate where the property is situated. For example a 2020 vehicle that costs 20000 would cost 300 for new registration. Are all made available to enhance your understanding of New Hampshires property tax system.

Florida uses a bracket system for collecting sales tax on any taxable sale that is less than a whole dollar amount. If a closing takes place on April 30th the tax bill covering that period will not be paid until July 1st. You will need mortgage insurance up to 20 equity which secures the payment of.

The real estate transfer tax is also commonly referred to as stamp tax mortgage registry tax and deed tax. More than other states New Hampshire counties count on the property tax to finance public services. This is your manual.

The median property tax on a 24970000 house is 464442 in New Hampshire. For a more specific estimate find the calculator for your county. The median property tax in New Hampshire is 463600 per year for a home worth the median value of 24970000.

State Education Property Tax Warrant. I hope this helps. How to Calculate Your NH Property Tax Bill.

Although the Department makes every effort to ensure the accuracy of data and information. By law the property tax bill must show the assessed value of the property along with the tax rates for each component of the tax. Census Bureau Number of cities that have local income taxes.

It usually accounts for the biggest piece of general. The buyer cant deduct this. If a closing takes place on January 31st the seller would have already paid the December bill which covers through March 31st.

New Hampshires real estate transfer tax is very straightforward. Search Valuable Data On Properties Such As Liens Taxes Comps Foreclosures More. Property tax bills in New Hampshire are determined using factors.

Ad Unsure Of The Value Of Your Property. New Hampshires tax year runs from April 1 through March 31. The tax rate is calculated by dividing the number of tax dollars needed by the total assessed value of all taxable property less total exemptions in the Town.

In calculating the sales tax multiply the whole dollar amount by the tax rate 6 plus the county surtax rate and use the bracket system to figure the tax on the amount less than a dollar. The result is the tax bill for the year. Take the Assessed Value of the property then multiply it by the Property Tax Rate and then divide it by 1000.

New Hampshire Real Estate Transfer Tax Calculator. If you are single an earned between 40401 445850 the tax rate is 15 if over 445850 then the tax rate is 20. The formula to calculate New Hampshire Property Taxes is Assessed Value x Property Tax Rate1000 New Hampshire Property Tax.

All offers due on Monday 37 at 300 PM. The federal withholding tax has seven rates for 2021. This means the buyer will need to reimburse the seller for taxes covering January 31st to March 31st.

The federal withholding tax rate an employee owes depends on their income level and filing status. For transactions of 4000 or less the minimum tax of 40 is imposed buyer and seller are each responsible for 20. New Hampshire has one of the highest average property tax rates in the country with only two.

Search Any Address 2. 18 per thousand for the current model year 15 per thousand for the prior model year. Find County Online Property Taxes Info From 2021.

To calculate the annual tax bill on real estate when the property owner isnt eligible for any exemptions multiply the assessed value by the total tax rate and divide the result by 1000. When you sell the property the basis reported on your tax return depends on whether the property is sold at a gain or loss. 0 5 tax on interest and dividends Median household income.

This estimator is based on median property tax values in all of New Hampshires counties which can vary widely. Property taxes are typically paid twice a year and covering the total annual cost of property taxes should be included in the monthly rental amount. Counties in New Hampshire collect an average of 186 of a propertys assesed fair market value as property tax per year.

New Hampshire Property Tax Calculator Smartasset

Understanding New Hampshire Taxes Free State Project

Historical New Hampshire Tax Policy Information Ballotpedia

New Hampshire Property Tax Calculator Smartasset

831 Union Avenue Laconia Nh Real Estate Mls 4903865 Adam Dow In 2022 Laconia Office Suite House Styles

The Ultimate Guide To New Hampshire Real Estate Taxes

New Hampshire S 20 Safest Cities Of 2022 Safewise

Town Manager Announces Tax Rate Set At 26 36 Newmarket Nh

Lowering New Hampshire Property Taxes Challenging Assessment Value

How We Fund Public Services In New Hampshire New Hampshire Municipal Association

My Property Taxes Are What Understanding New Hampshire S Property Tax Milestone Financial Planning

Nh Had Seventh Highest Effective Property Tax Rate In 2021 Report Says Nh Business Review

2021 Tax Rate Set Hopkinton Nh

Understanding New Hampshire Taxes Free State Project

New Hampshire Property Tax Calculator Smartasset

Budget Replaces Targeted Aid With Tax Cut Disproportionately Benefitting Owners Of Higher Valued Properties Reachinghighernh

Residential Taxpayer Resources Nashua Nh

New Hampshire Income Tax Calculator Smartasset

New Hampshire Estate Tax Everything You Need To Know Smartasset