income tax rates 2022 ireland

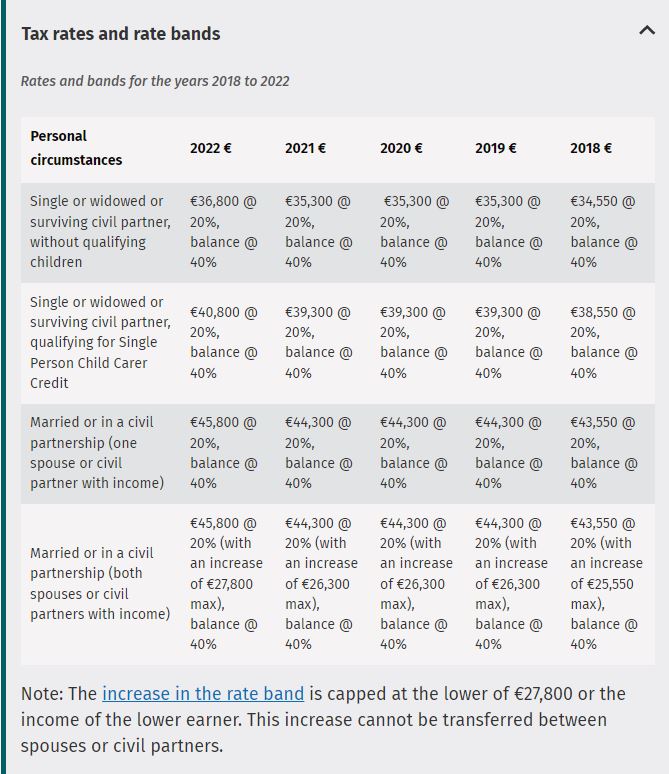

Single persons can avail of an annual tax credit relief of 1650 which can be raised up to 3300 for married couples. 4 rows Rates and bands for the years 2018 to 2022.

Roblox Gains Steam After Market Debut As Cathie Wood S Ark Picks Up Shares Roblox Investment Firms Living In New York

The total deductions in a year will be 1831 made up of.

. Or 40950 a week. This money has been accredited to changes to income tax bands that will enable two-thirds of workers to take home more of their pay. Aggregate income for USC purposes does.

Tax-rate band increases. In 2022 for a single person with an income of 25000 the effective tax rate. The standard rate tax band the amount you can earn before you start to pay the higher rate of tax will be increased by 1500.

Ireland Annual Salary After Tax Calculator 2022. Aggregate income for the year is 60000 or less. Tax rates range from 20 to 40.

5 rows 2022 EUR Tax at 20. Use our interactive calculator to help you estimate your tax position for the year ahead. Personal Tax Credits in Ireland from January 2022 Single Taxpayers.

Have a 3 surcharge so they pay 11 USC People with Income under 13000 are exempt from USC. 2022 The CSO did some really. Individuals aged under 70 who hold a full medical card whose aggregate income for the year is 60000 or less.

Personal Income Tax Rate in Ireland averaged 4565 percent from 1995 until 2020 reaching an all time high of 48 percent in 1996 and a record low of 41 percent in 2007. Workers on this rate will notice an increase in the money they take home which is now at 1520. Everyone who is employed can also.

Basic income tax rates in Ireland. In the final phase of March and April 2022 a flat rate subsidy of 100 per qualifying employee will be paid. The Irish government announced in connection with Budget 2022 released October 12 a planned increase in the corporate tax rate to 15 in line with last weeks OECD tax agreement.

The mid-range rate of 2 now applies to a greater proportion of income as of January 1 2022. The Budget 2022 package includes approximate 520m in tax cuts. What will the provisions contained in Budget 2022 mean for you.

Non-resident companies are subject to Irish corporation tax only on the trading profits of an Irish branch or agency and to Irish income tax generally by way of withholding on certain Irish-source income. Terms conditions and assumptions. The income values for each tax bracket are shifted slightly depending on.

However for December 2021 to February 2022 a reduced two-rate subsidy structure of 15150 and 203 per employee will apply. By Doug Connolly MNE Tax. The Personal Income Tax Rate in Ireland stands at 48 percent.

2 days agoThe increase was driven again by the corporate tax that is mainly paid by Irelands large hub of multinational companies. The following tax credits will increase by 50. Ireland Income Tax Brackets and Other Information.

Calculate your income tax. Tax Bracket yearly earnings Tax Rate 0 - 36400. 0 12012 05.

The Annual Wage Calculator is updated with the latest income tax rates in Ireland for 2022 and is a great calculator for working out your income tax and salary after tax based on a Annual income. 12012 21295 2. In short the government has increased all standard tax-rate bands by 1500.

2021 Rate 2022 Rate Income up to 05 Income up to 05 Income above 20 Income above 20 Note 1. Personal tax credits of 1700 PAYE tax credit of 1650 Income Tax Rate. The personal income tax system in Ireland is a progressive tax system.

The calculator is designed to be used online with mobile desktop and tablet devices. The budget also includes expanded relief for start-up companies a new tax credit for the digital gaming sector and planned anti-tax avoidance rules. Corporate receipts rose by 529 year-on-year to 88 billion euros making.

As well as income tax other deductions are taken from wages in Ireland. Income tax rates will stay the same at 20 and 40 but there will be increases to tax credits and changes to the income tax bands. 21294 in a year before deductions of Income Tax USC and PRSI This is equivalent to 1774 per month.

For the Irish income tax there are two rates. 20 for single people with an income of up to 34550 per year and 40 for an income above. This page provides the latest reported value for - Ireland Personal Income Tax Rate - plus previous releases historical high and low short-term.

Someone aged 20 or more earning the Minimum Wage in Ireland in 2022 of 1050 per hour working full time 39 hours a week will earn. Tax Rates and Credits 2022 Value Added Tax changed Standard ratelower rate 23135 Hospitality and tourism newspapers electronically supplied publi-cations and sporting facilities 9 Flat rate for unregistered farmers rate decreased 55 Cash receipts basis threshold 2m 9 rate applying to hospitality and tourism sector extended to 31 August 2022 Dividend. From tomorrow the standard rate band for all earners will rise from 35300 to 36800 for single earners from 39300 to 40800 for.

Single and widowed person. 1 day agoA new 30 tax rate for middle-income earners has not been ruled out according to Tánaiste Leo Varadkar. Self -employed workers with an income over 100000.

A brief summary of the Income Tax Rates in Ireland is given below the figures shown are valid from January 2022. Resident companies are taxable in Ireland on their worldwide profits including gains. Further there will be a return to full rates of employer PRSI with effect from March 2022.

This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates. Ireland Income Tax Brackets. Summary of USC Rates in 2022.

Mongodb Internship 2022 Hiring Business Development Research Interns Of Any Graduate Degree In 2022 Business Development Apply For Internship Internship

Tax Revenue Statistics Statistics Explained

Employments In Respect Of Which There Is A Shortage In Respect Of Qualifications Experience Or Skills Which Are Required For Skills Qualifications Occupation

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

A Teenager Tracked Elon Musk S Jet On Twitter Then Came The Direct Message In 2022 Elon Musk Tweet Quotes Messages

Corporation Tax Europe 2021 Statista

Paying Tax In Ireland What You Need To Know

Tax Services Include Tax Deductions Accounting Job And Online Accounting We Have The Best Quality Accountants On Bookkeeping Services Accounting Tax Attorney

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

Ireland Tax Income Taxes In Ireland Tax Foundation

Poland Personal Income Tax Rate 2022 Data 2023 Forecast 1995 2021 Historical

Payroll Preparation For Year End And Year Beginning 2021 Accounting Services Payroll Payroll Software

2022 Capital Gains Tax Rates In Europe Tax Foundation

How Do Taxes Affect Income Inequality Tax Policy Center

Payroll Preparation For Year End And Year Beginning 2021 Accounting Services Payroll Payroll Software

Pin On Set Up Travel Services Business In Vietnam

Ireland Tax Income Taxes In Ireland Tax Foundation

How Business Structure Affects Taxation Business Tax Income Tax Estate Tax